Health Insurance plans and coverage for everyone.

11632 Dove Hollow Avenue,

Newsletter • Insurance Licenses

Privacy Notice

Sitemap

Select an item from the list to view information for that item.

You may also show all on the page at once.

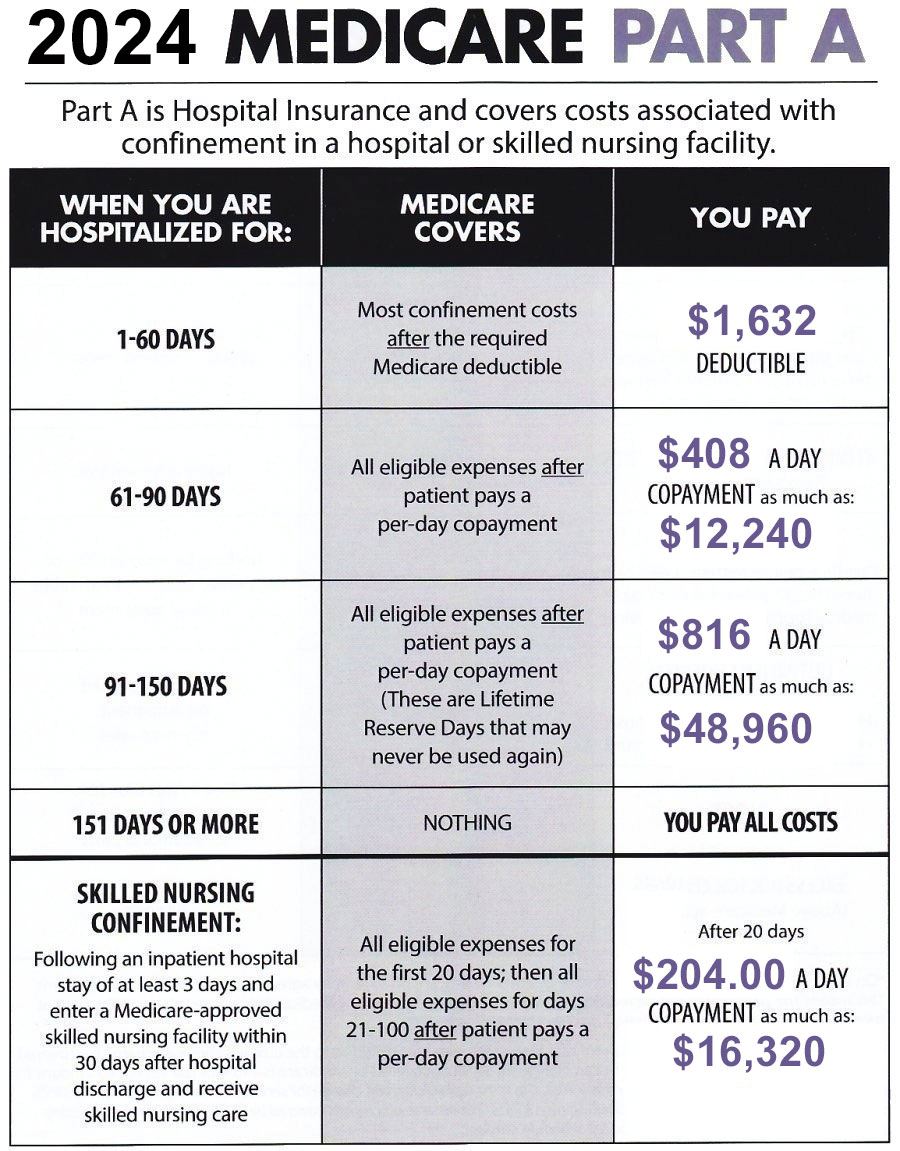

Medicare Part A is hospital insurance. Part A covers inpatient hospital care, limited time in a skilled nursing care facility, limited home health care services, and hospice care.

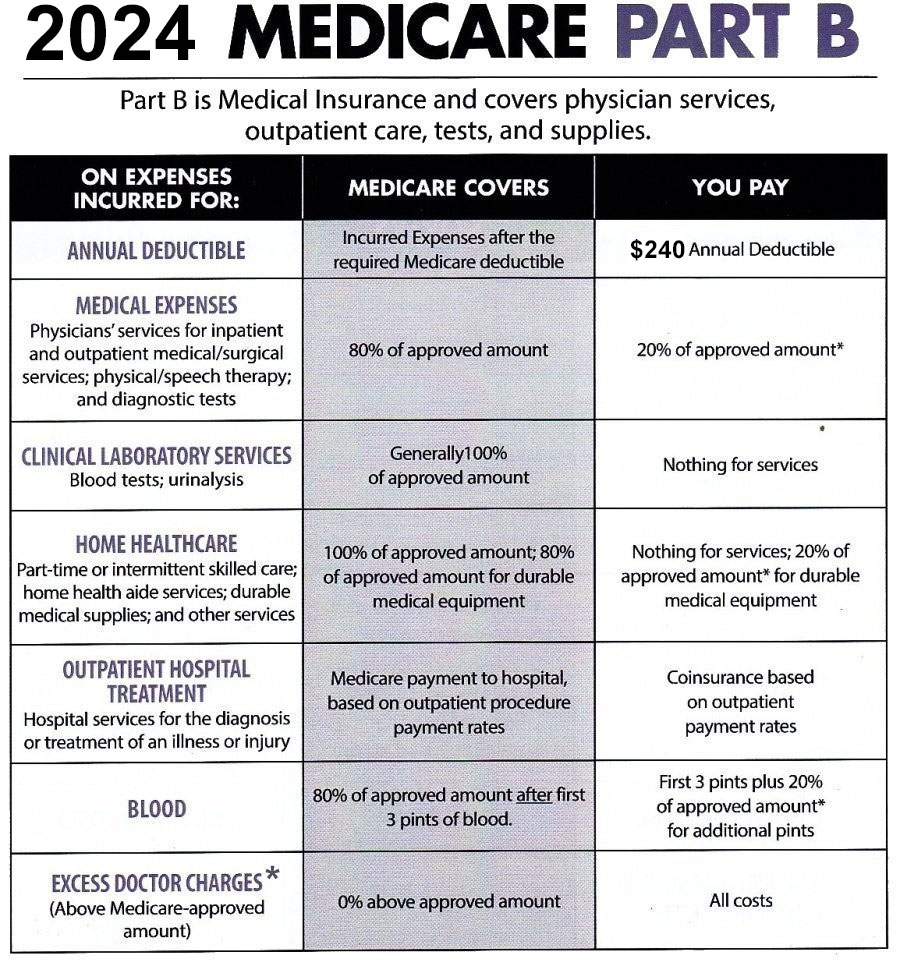

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

*On all Medicare-covered expenses, a doctor or other healthcare provider may agree to accept Medicare assignment. This means the patient will not be required to pay any expense in excess of Medicare's approved charge. The patient pays only 20% of the approved charged not paid by Medicare.

Physicians who do not accept assignment of a Medicare claim are limited as to the amount they can charge for covered services. The most a physician who does not accept Medicare assignment can charge for services covered by Medicare is 115% of the Medicare allowable amount. This additional charge is referred to as “excess charges.” Currently, excess charges are not permitted to be assessed in Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, or Vermont.

See this guide that explains Medicare Part B Excess Charges.

Enrollment in Parts A and B is automatic when you're 65 and receiving Social Security or Railroad Retirement benefits (of if you have Lou Gehrig's disease or have received Social Security disability benefits for 24 months). If you're automatically enrolled, you'll receive your red, white, and blue Medicare card in the mail 3 months before your 65th birthday or your 25th month of disability.

You need to sign up for Parts A and B if you aren't already receiving Social Security or Railroad Retirement benefits. You can enroll by leaving this website and going to the Social Security website at https://secure.ssa.gov/iClaim/rib. If the site askes you if you are enrolling for Part A and/or B answer Yes. The site will also ask you if you are applying for Social Security. Be sure you answer this question correctly because if you don’t you could be signed up to receive Social Security if you don’t want to or vice versa.

HOW TO SIGN UP FOR PART B IF YOU'RE NOT AUTOMATICALLY ENROLLED.

We recommend you start the process the first of the month three months before your birthday month (your birthday month is always considered the first of the preceding month if your 65th birthday is on the first of the month).

When you're first eligible for Medicare, you have a 7-month Initial Coverage Enrollment Period ("ICEP") to sign up for Part A and/or Part B. This period begins three months before your 65th birthday month and ends the last day of the third month after your birth date month. We recommend signing up for Medicare early in the third month before your effective date to avoid any delays in enrollment dates. Your enrollment date will be the first of the month in which you are eligible if you apply before that date or the first of the following month if you submit during your eligibility month or any of the following three months. Unless you're enrolled in a group plan covering more than 20 people there will be a penalty and a restricted enrollment period between January 1 and March 31 (called the “General Enrollment Period”) if you don't enroll during the ICEP.

Use this CALCULATOR to get an estimate of when you're eligible for Medicare.

If you're eligible for premium-free Part A (see question 8 for a definition of "premium free" Part A) because you or your spouse have paid Medicare taxes for at least 40 quarters (10 years), you can sign up for Part A at any time.

If you must buy Part A and/or Part B, you can only sign up during a valid enrollment period. If you don't enroll when you're first eligible [generally three months before and up to three months after your 65th birthday month (there are special rules for individuals who don't enroll because they had group coverage with an organization with more than 20 employees)], in most cases you can only enroll in Parts A and/or B between January 1 and March 31 (the "General Enrollment Period"), and coverage for a Medicare Supplement, Medicare Advantage, Medicare Advantage Prescription Drug, or Medicare drug coverage (Part D) will begin the first of the month of your Part A or B effective date (whichever is later) if you submit your enrollment prior to the beginning of that month. Otherwise, contact us at 877-734-3884 (TTY: 711) to determine if you’re eligible for a Special Enrollment Period.

There are special enrollment periods for enrollment in Part B and non-premium free Part A for these situations for those who can’t sign up when first eligible:

You cannot use the Annual Enrollment period that runs from October 15 to December 7 to enroll in Medicare Part A or Part B. That enrollment period can only be used by people with Medicare to sign up for Medicare Advantage, Medicare Advantage Prescription Drug, or separate Medicare drug coverage (Part D), or switch coverage that you already have.

There's a late enrollment penalty if you don't sign up for Medicare Part B when first eligible.

You have six months from your Part B effective date to enroll for a Medicare Supplement plan without having to answer medical questions. Otherwise, you can enroll at any time, but you will need to pass medical underwriting rules for the specific carrier you are applying for.

You can enroll in a Medicare Advantage or Medicare Advantage Prescription Drug Plan three months before and up to three months after the later of your Part A or Part B effective date. Otherwise, you can enroll in one of these types of plans ONLY if you have a Special Enrollment Period or during the Annual Enrollment Period.

You can enroll for Medicare drug coverage (Part D) three months before and up to three months after the month of your Part A OR Part B effective date, whichever is earlier. Otherwise, you can enroll in Medicare drug coverage (Part D) ONLY if you have a Special Enrollment Period or during the Annual Enrollment Period.

See the Medicare Supplement, Medicare Advantage (Part C) and/or Medicare Drug Coverage (Part D) pages for additional details or call us at 877-734-3884 (TTY: 711) for more information because the rules for enrolling in one of these plans when you've enrolled for Part A or B during general enrollment (or when leaving an employer group plan) are unique and not well understood.

If you didn't sign up for Parts A and/or B because you had employer group coverage based on current employment and your employer has more than 20 employees, you can enroll in Parts A and/or B any time as long as you or your spouse are working and are covered under group coverage. (If your employer has 20 or fewer employees you should sign up for Part B when first eligible or you will be assessed a late enrollment penalty when you finally sign up.)

If your employer provides group coverage and you are enrolled in an employer group plan, you also have an 8-month period to sign up for Part A and/or B that begins the month after employment ends or the group health plan insurance based on current employment ends. There's no penalty provided you sign up within 8 months after the loss of group coverage.

Most individuals of employers with more than 20 employees who are about to retire and have had employer coverage will have been enrolled in Medicare Part A but not Part B, and it's important to sign up through your local Social Security office before the first of the month of retirement and to request that effective date in order to avoid a gap in coverage. You'll need to:

Most Medicare Part A beneficiaries don't have to pay a monthly premium to receive coverage under this part of Original Medicare; this is called "premium-free Part A." Generally, if you've worked at least 10 years (40 quarters) and paid Medicare taxes while you worked, you're eligible for premium-free Part A. Otherwise, you pay a monthly premium.

About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. Enrollees aged 65 and over who have fewer than 40 quarters of coverage and certain persons with disabilities pay a monthly premium to voluntarily enroll in Medicare Part A. Individuals who had at least 30 quarters of coverage or were married to someone with at least 30 quarters of coverage may buy into Part A at a reduced monthly premium rate, which will be $278 in 2024, which is not changed from 2023. Certain uninsured aged individuals who have less than 30 quarters of coverage and certain individuals with disabilities who have exhausted other entitlement will pay the full premium, which will be $505 a month in 2024, a $1 decrease from 2023.

You pay a monthly premium for Part B of Original Medicare. The fee can be higher for people with high incomes (see FAQ 9 below.)

Beneficiaries new to Medicare in 2016 and later pay $174.70 for Part B in 2024, an increase of $9.80 from the $164.90 paid in 2023. (This is called the "standard" Part B premium.) The increase for 2024 is due mainly to medical cost inflation but is also affected by the inclusion of a new Alzheimer’s drug called Leqimba in Part B as well as a change in payments to providers required by the Hospital Outpatient Prospective Payment System.

Because of the "hold harmless" provision, increases in Medicare premiums can't cause a person's Social Security benefits to decline from one year to the next. Unless an individual has or ever had to pay IRMAA payments (see question 9), an individual’s net Social Security benefit can’t decrease because of an increase in Part B premiums.

Beneficiaries with Modified Adjusted Gross Incomes (MAGI) above a certain amount (see answer to question 9) pay a higher amount.

The Social Security cost of living (COLA) benefit increase was 8.7% in 2023 and will increase 3.2% in 2024.

Part B Benefit And Premium For Beneficiaries With Kidney Transplants

Certain Medicare enrollees who are 36 months post-kidney transplant, and therefore are no longer eligible for full Medicare coverage, can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. For 2024, the immunosuppressive drug premium is $103.00, an increase of $5.90 from 2023.

For 2024 individuals filing single returns (as well as married individuals who file separate returns) with income over $103,00 (an increase from $97,000 that applied for 2023 calculations ) and joint filers with income over $206,000 (an increase from $194,000 for 2023 calculations) pay additional premiums both for Medicare Part B and for Medicare drug coverage (Part D). (Note: Part D IRMAA applies both to Medicare Advantage Prescription Drug Plans and separate Medicare drug coverage (Part D). LEARN MORE about how IRMAA is calculated.

IRMAA Premiums for 2024

IRMAA is calculated annually based on income reported on the tax return from two years’ previously. If no return has been filed, then they’re based on the most recent income tax return that is on file with the IRS. The income levels upon which IRMAA is based are adjusted for cost-of-living, and the various levels in the charts are periodically changed legislatively as well.

See these charts for 2024 IRMAA Part B premiums and for 2024 IRMAA Part D premiums.

Individuals who have experienced one of the following life changing events can file a form SSA-44 to request a reduction in their IRMAA if one of the following events occurs:

This table shows the total 2024 IRMAA Part B premium for high-income beneficiaries with immunosuppressive drug only Part B coverage as described in FAQ 8.

Use this CALCULATOR to determine your Medicare Part B Premium.

You must have both Parts A and B to enroll in a Medicare Advantage or Medicare Advantage Prescription Drug plan. There are no medical questions.

You can buy a Medicare Advantage or Medicare Advantage Prescription Drug plan only (1) when you are first eligible; (2) between October 15--December 7 for a January 1 effective date; or (3) during a Special Enrollment Period. You can change to a different Medicare Advantage or Medicare Advantage Prescription Drug Plan between January 1--March 31 during what is called the Open Enrollment Period if you already have a Medicare Advantage or Medicare Advantage Prescription Drug Plan. (If you enroll in a Medicare Advantage or Medicare Advantage Prescription Drug Plan during your Initial Coverage Election Period, you can change to a different Medicare Advantage or Medicare Advantage Prescription Drug plan during the first three months starting with the month you became eligible for Parts A and B.) LEARN MORE ABOUT MEDICARE ADVANTAGE (PART C) PLANS.

You must have Part A and/or Part B to buy separate Medicare drug coverage (Part D). There are no medical questions. You can only buy a Part D Prescription Drug plan when you're first eligible, between October 15--December 7 for a January 1 effective date, during a Special Enrollment Period, or, if you have a Medicare Advantage or Medicare Advantage Drug Plan and elect to go back to Original Medicare during the Open Enrollment Period [(1/1-3/31 or the first three months after enrolling in a Medicare Advantage or Medicare Advantage Prescription Drug Plan during your Initial Coverage Election Period (i.e. starting with the month you first became eligible for Parts A and B of Medicare)]. LEARN MORE ABOUT MEDICARE DRUG COVERAGE (PART D).

If you must buy Part A and/or Part B, you can only sign up during a valid enrollment period. If you don't enroll when you're first eligible [generally three months before and up to three months after your 65th birthday month (there are special rules for individuals who don't enroll because they had group coverage with an organization with more than 20 employees)], in most cases you can only enroll in Parts A and/or B between January 1 and March 31 (the "General Enrollment Period"), and coverage for a Medicare Supplement, Medicare Advantage, Medicare Advantage Prescription Drug, or Medicare drug coverage (Part D) begins the first of the month of your Part A or B effective date (whichever is later) if you submit your enrollment prior to the beginning of that month. Otherwise, contact us at 877-734-3884 (TTY: 711) to determine if you’re eligible for a Special Enrollment Period.

You may qualify to save money on health care and/or drug costs if you are eligible for any of these programs.

We ONLY offer alternatives that are suitable for you and for which we feel meet YOUR needs.

When or if we feel a product or service is not appropriate for you from either a cost or benefit point of view we will tell you so.

We’re fully compliant with privacy and security guidelines, have signed all required privacy and security agreements, have developed a privacy and security policy, and take extraordinary steps to safeguard your protected health and personal information.

In short, we’re experts in all aspects of health and life insurance and also have relationships with professionals who can help you with very specialized situations.