Health Insurance plans and coverage for everyone.

11632 Dove Hollow Avenue,

Newsletter • Insurance Licenses

Privacy Notice

Sitemap

Select an item from the list to view information for that item.

You may also show all on the page at once.

The Inflation Reduction Act was signed into law on September 16, 2022 and contains changes that affect Medicare-eligibles who are enrolled in MAPD (Medicare Advantage Prescription Drug Plans) or separate Medicare drug coverage (Part D):

This article from the Kaiser Family Foundation contains an excellent overall summary of the Act and how Medicare beneficiaries are affected.

These three provisions became effective January 1, 2023 and affect all beneficiaries who are enrolled in MAPD or Medicare drug coverage (Part D).

The following changes to what is called the “standard” Part D prescription drug model have been made for 2024.

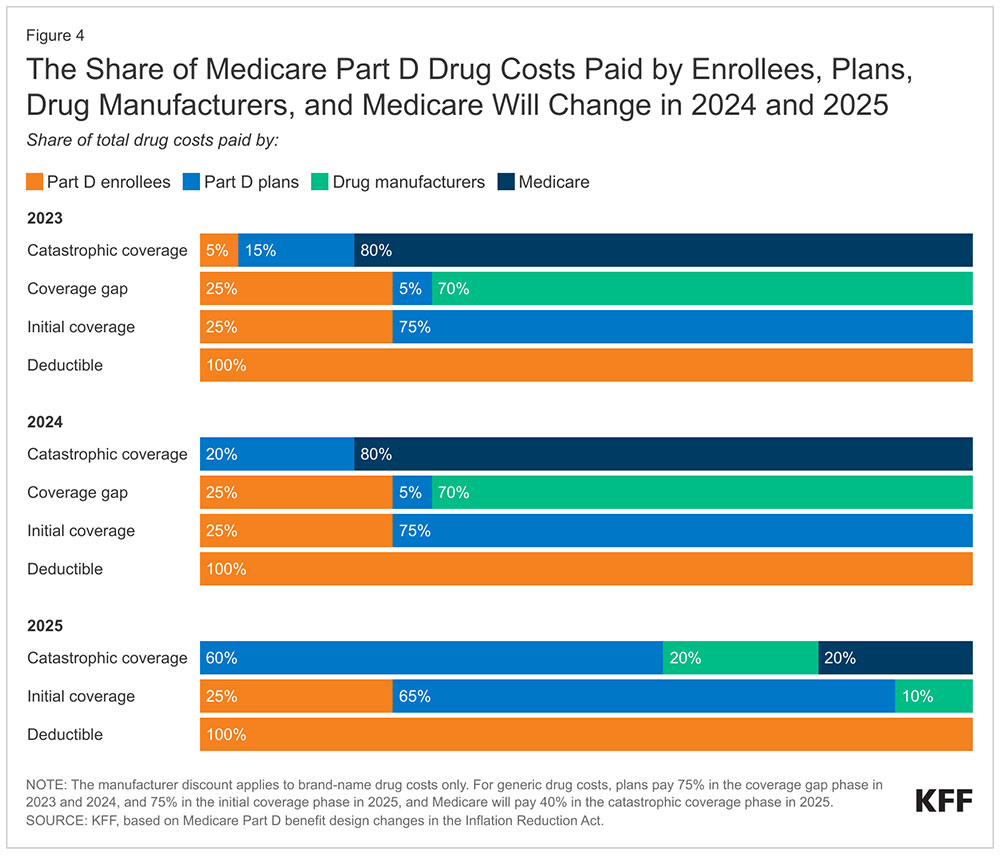

The standard design of the Medicare Part D benefit has four distinct phases, where the share of drug costs paid by Part D enrollees, Part D plan carriers, drug manufacturers, and Medicare varies. [The Part D enrollee shares indicated below reflect costs by enrollees who are not receiving low-income subsidies (also known as “extra help.”] Note: All Part D plans must cover at least the Part D standard benefit or meet the requirements for “alternative benefits.” Benefit structures that are not standard but instead are actuarially equivalent are known as “alternative” coverage.

Note that entry into the coverage gap phase is based on the total cost of the enrollee’s medications in the deductible and initial coverage level phases, whereas a different calculation [called “true out-of-pocket” costs (TrOOP)] is used for calculation of the “out-of-pocket” threshold. Generally, TrOOP includes enrollee (i.e., NOT the total) payments for Part D prescription drugs, including the annual deductible, cost-sharing above the deductible and up to the initial coverage limit, and above the initial coverage limit up to the annual out-of-pocket threshold. The following items are also included in TrOOP:

There will be NO CHARGE for medications once the enrollee meets the catastrophic phase in 2024. According to the Kaiser Family Foundation once an enrollee personally pays approximately $3,300 in 2024 he or she will have no further costs for covered medications in 2024. (This number will vary according to the actual medications an individual takes and in many cases will be lower than the Kaiser Family Foundation projection. We have software that can project when a beneficiary will meet the catastrophic threshold in 2024 based on his or her list of medications; please contact us at 561-734-3884 and we can make these projections for you.)

Part D carriers previously paid 15% of the cost of medications in 2023 once the out-of-pocket threshold was met. In 2024 carriers will be required to pay 20% of the cost of medications once this threshold is met; Medicare pays the balance of the cost.

Individuals on expensive medications will be greatly benefitted by this change to the catastrophic coverage stage. For example, the Kaiser Family Foundation has reported that enrollees on one of the top five high-cost, commonly used cancer drugs will be reduced by thousands of dollars in 2024. For example, those on Pomalyst will save $8,500; while those on Revlimid, Imbruvica, Jakafi, and Ibrance will save $6,400, $6,400, $5,900, and $5,000, respectively.

Because of this change to the catastrophic phase in 2024, those who buy some medications outside of the plan (e.g., from Good Rx or other non-plan resources) and who otherwise would meet the out-of-pocket threshold should consider changing their strategy and buy all their medications through the plan in 2024, as this could result in lower costs. This recommendation will be even more important in 2025 (see FAQ 4) because of the changes being made to drug plans next year.

Drug formularies (the list of covered medications) differ between all carriers and even between different plans offered by the same carrier.

Other Changes For 2024

Drug plans will experience more significant change in 2025.

Out-of-pocket drug spending for covered medications will be capped at $2,000; this number will be indexed starting in 2026.

The coverage gap (aka “donut hole”) phase will be eliminated. This means that copays/coinsurance levels will remain unchanged from the initial coverage level until the $2,000 cap is met. Once that cap is met, there will be no cost for covered medications to the beneficiary.

This means that all plans will have a maximum of three different phases: (1) the deductible phase, if any); (2) the initial coverage level phase; and (3) the catastrophic phase.

Part D enrollees will have the option of spreading out their out-of-pocket costs over the year rather than face high out-of-pocket costs in any given month.

Also, the share of Medicare Part D drug costs paid by plans, drug manufacturers, and Medicare will change.

Because of these changes, beneficiaries should expect major changes in the design and possibly the premiums for 2025 drug plans. These changes won’t be published until October 1, 2024 but will be included in Annual Notice of Change (ANOC) documents beneficiaries receive in September.

See the following Kaiser Family Foundation chart for changes between 2023, 2024, and 2025 regarding share of Medicare Part D drug costs paid by enrollees, Plans, Drug Manufacturers, and the government (i.e., Medicare) in each drug phase.

Please see this article from the Kaiser Family Foundation for a more detailed summary of the 2024 and 2025 changes.

Unless you're eligible for a Special Election Period, you must enroll in a Medicare Advantage Prescription Drug Plan or Medicare drug coverage (Part D):

Note: Medicare begins the first of the preceding month for individuals whose birthday is the first day of the month.

Some Medicare Advantage plans (called "MAPD" plans) include prescription drug coverage while others (called "MA" or "MA Only" plans) do not.

If you purchase a Medicare Advantage HMO or PPO plan without prescription drug coverage, you CAN'T purchase a separate Part D plan. You can purchase a separate Part D plan with a PFFS (Private Fee for Service plan) that doesn't provide drug coverage and with Medicare Savings Account plans and Cost plans (Cost plans are available on a very limited basis and are not available in Florida).

You can also purchase separate Medicare drug coverage (Part D) with a Medicare Supplement plan or with Original (Fee for Service) Medicare (i.e., without enrolling in either a Medicare Supplement or Medicare Advantage plan).

Although they must meet minimum Federal guidelines, Medicare Advantage Prescription Drug and separate Medicare drug coverage (Part D) differ markedly between carriers, and one of the most important differences is which drugs are covered and which are not. [There are 35 therapeutic categories of drugs, and carriers are required to include at least two drugs in each category, except they are required to include all drugs in these categories: HIV/AIDS treatments; antidepressants; antipsychotic medications; anticonvulsive treatments for seizure disorders; immunosuppressant drugs; and anticancer drugs (unless covered by Part B)].

Each carrier provides a formulary that lists which drugs are covered under that plan and which copay or coinsurance tier the drug falls into. Beneficiaries should always check the formulary to determine if their drugs are covered--and at which copay pay or coinsurance rate--before purchasing a plan. It's also a good idea to review your Medicare Advantage Prescription Drug or separate Medicare drug coverage (Part D) every year to see if your plan covers the medications you need now and may need in the upcoming year.

Each carrier provides a formulary that lists which drugs are covered under that plan and which copay or coinsurance tier the drug falls into. Beneficiaries should always check the formulary to determine if their drugs are covered--and at which copay pay or coinsurance rate--before purchasing a plan. It's also a good idea to review your Medicare Advantage Prescription Drug or separate Medicare drug coverage (Part D) every year to see if your plan covers the medications you need now and may need in the upcoming year.

Be sure to talk to your doctor to see if you're taking the lowest cost medications available to you.

Because Part D plans can be designed to be actuarially equivalent to the standard benefit model (see FAQ 2) , these plans can have no or lower deductibles than required by the standard benefit model, copays and/or coinsurance can vary, and there can be other differences in plan design as well. Specific coverage will vary from plan to plan, so read your documentation carefully and make sure to check out which of your drugs are included in your plan’s formulary.

Medicare (CMS) has a formulary finder on their website that permits beneficiaries to enter their medications, dosages, and frequency of use and then lists the carriers that cover these medications in their formulary. After the beneficiary enters his or her drugs into the formulary finder there are various options as to how to present the findings: i.e., list in order of plans with the lowest premium; list in order of lowest premium AND cost of drugs; and list in order of plans with the lowest deductible.

Note: We use a sophisticated formulary finder called Search and Save. Our tool uses four different feeds from Connecture (Medicare.gov also uses data supplied by Connecture but the Search and Save system utilizes more extensive data than that used by Medicare.gov.) We can input clients’ medication data and determine which Medicare Advantage or separate Medicare Part D coverage plan has the lowest drug costs (considering both premium and the cost of the drugs) for clients and prospects.

Please contact us at 561-734-3884 or 877-734-3884 for help in determining your outpatient medication costs.

Plans are required to include medication therapy management including step therapy, quantity limits and prior authorization. Part D sponsors may substitute generic drugs for brand name drugs if the generic drugs have the same or lower cost sharing and certain conditions are met. In accordance with the Comprehensive Addiction and Recovery Act (CARA), plans may impose certain limitations to manage utilization for beneficiaries who are at risk of misusing or abusing frequently abused drugs, such as opioids.

You may owe a late enrollment penalty (LEP) if, at any time after your initial enrollment period is over there is a period of 63 or more continuous days when you don't have Part D or other creditable coverage (i.e. coverage that, as a minimum, meets the Part D standard benefit model).

The late enrollment penalty is assessed for EACH month that you haven't had creditable drug coverage.

The amount of the penalty changes annually and is based on each year's national average Part D premium ($34.70 for 2024). Note: the Inflation Reduction Act puts a cap of 6% concerning the percentage this number can increase from year to year. The 2024 number has been capped at 6% above the 2023 number, which was $32.74.

Part D Prescription Drug Plan premiums are adjusted if your income exceeds a certain level. This additional premium (called the IRMAA) will be deducted from your Social Security check and is in addition to your premium for the basic plan. (You will have to pay Social Security directly for any IRMAA payments if you are not drawing Social Security.)

The Bipartisan Budget Reconciliation Act of 2018 changed how IRMAA is calculated. See FAQ 9 in the Medicare Overview FAQs for details. See these charts at 2024 IRMAA Part D premiums.

Here are a number of ways you can save on drug costs.

In addition, this article by Bankrate contains a number of good suggestions. Bankrate suggests looking into patient assistance programs at www.rxassist.org (this site contains a wealth of other useful information); shop around for the best prices on medications; tread carefully using current credit cards (look closely before choosing to use a medical credit card), and talk to your physician about switching to generics.

For a complete listing of plans available in your service area please contact 1-800-Medicare (TTY users should call 1-877-486-2048) or go to www.medicare.gov. Your copy of Medicare & You 2024 also contains a listing of 2024 plans available in your general area. You can also contact us at 877-734-3884 (TTY: 711) for this information. (Medicare & You 2024, is published and mailed to all those enrolled in Medicare (except for the most recent enrollees) in late September. Note: the linked version of Medicare & You included here does not contain listings of plans in your general area.)

We ONLY offer alternatives that are suitable for you and for which we feel meet YOUR needs.

When or if we feel a product or service is not appropriate for you from either a cost or benefit point of view we will tell you so.

We’re fully compliant with privacy and security guidelines, have signed all required privacy and security agreements, have developed a privacy and security policy, and take extraordinary steps to safeguard your protected health and personal information.

In short, we’re experts in all aspects of health and life insurance and also have relationships with professionals who can help you with very specialized situations.