This FAQ clarifies that, beginning with Plan Year 2026 APTC reconciliation (when consumers are filing their taxes in 2027), there is no limitation on excess APTC consumers have to repay when filing their tax return and reconciling their APTC.

Call today for quotes on

or

Health Plan FAQ’s

The Affordable Care Act is complicated and can be quite confusing. Find answers to many of the most frequently asked questions regarding provisions of the law that affect individual and family health insurance.

Select an item from the list to view information for that item.

You may also show all on the page at once.

1. What Changes Made By The 2021 American Rescue Plan Act And 2022 Inflation Reduction Act Apply for 2024 and 2025?

The American Rescue Plan Act (ARPA) and its successor law, the Inflation Reduction Act made a number of significant changes to the Affordable Care Act. Prior to these laws individuals and families in almost all cases were eligible for tax credits (also referred to as subsidies) based on their income falling between 100% (in non-Medicaid expansion states like Florida) and 138% (in Medicaid expansion states) and 400% of the Federal Poverty Level. These tax subsidies reduce the gross premium that would otherwise be due from the policyholder. Individuals and families falling above 400% of the Federal Poverty Level (FPL) could not previously qualify for tax credits.

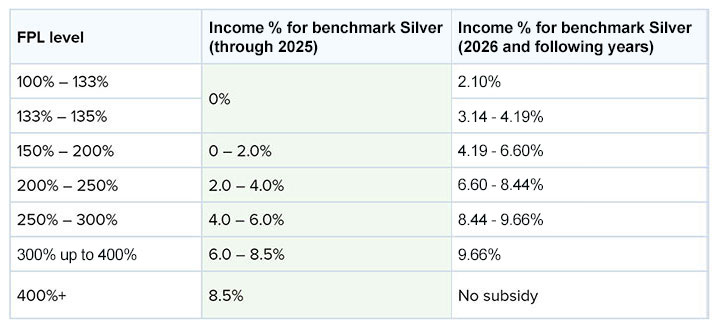

Under ARPA, the subsidy calculations (see following chart) were liberalized based on income as a % of the cost of the second lowest benchmark Silver plan (see FAQ 19) in their zip code for those falling between 100 and 400% of the FPL, and people falling above 400% of the FPL became eligible for tax subsidies for the first time. The Inflation Reduction Act extended these changes through December 31, 2025, but these enhanced subsidies were NOT continued under the recently-enacted One Big, Beautiful Bill Act (OBBBA).

Tax subsidies are calculated based on a person’s age, income, and zip code of residence. They’re calculated based on how their family income relates to the cost of the second lowest cost Silver plan offered in their zip code. The cost of the plan differs according to age, zip code and family size, and the calculation assumes that all family members are non-smokers. Under the American Rescue Plan Act and as continued under the Inflation Reduction Act through December 31, 2025, the % of income requirements were lowered for all poverty levels, and those making over 400% were limited to paying 8.5% of their income for the second lowest cost silver plan in their area (this is referred to as the “benchmark” plan). Here is a comparison of the calculations being used through 2025 compared against how the calculations will be made starting with plans for 2026.

Subsidy Calculations—2025 And 2026

(Households Making Above 400% Of The FPL Are Eligible For Subsidies In 2025 But Will Not Be In 2026)

2. When Can I Enroll In An Affordable Care Act Plan?

The Affordable Care Act establishes an Open Enrollment Period (OEP) during which individuals and families must enroll UNLESS they have a "qualifying life event."

The Open Enrollment Period for 2026 plans on healthcare.gov ran from November 1, 2025 through January 15, 2026. Those enrolling by December 15 have a January 1, 2026 effective date, whereas those enrolling between December 16, 2025 and January 15, 2026 have a February 1 effective date. Some states do not participate on healthcare.gov and are permitted to have different dates for open enrollment.

The OEP will change for plan year 2027. OEP on healthcare.gov will run from November 1 to December 15. State-based exchanges will be permitted to have an OEP not exceeding 9 weeks, but the OEP must start no earlier than November 1 and end no later than December 31. All enrollments pursuant to the Open Enrollment Period must begin on January 1. Off-Marketplace plans must follow the same dates as the on-Marketplace plans in each state.

Contact your local state exchange for details if your state does not participate on healthcare.gov. Look here for information about state Exchanges (these are also referred to as “marketplaces.”) See FAQ 7 for an explanation of Exchanges.

3. Under What Circumstances Can I Enroll In A Plan Outside Of Open Enrollment?

A Special Enrollment Period lets you enroll in health coverage or switch plans outside of Open Enrollment, or during Open Enrollment for an earlier coverage start date. You must have a Qualifying LIfe Event (QLE) to qualify for a Special Enrollment Period.

4. Applying For A Plan During A Special Enrollment Period, Required Documentation, and Effective Date of Coverage

The effective date of coverage for a plan for someone applying using a Special Election Period (SEP) is the first day of the following month.

If you are applying for the first time or changing carriers, you must make your first payment (called a “binder payment”) prior to the effective date of coverage or as otherwise specified by the carrier.

When you apply for a plan on healthcare.gov, you will receive an eligibility verification notice. This notice will indicate the amount of household income you projected for the year, the amount, if any, of your advance premium tax credit (subsidy) that reduces your gross premium, and what documents, if any, you are required to submit to healthcare.gov. You may be required to submit proof of income, citizenship, and/or immigration status, and you also may be required to submit documentation proving your eligibility for the SEP.

Please contact us at 786-970-0740 (Cell) for further information.

5. Are Providers Different Under Affordable Care Act Plans?

Qualified Health Plans (see FAQ 6) must have networks. A network is a group of healthcare providers or pharmacies who are contracted with the insurance carrier to provide medical services or prescription drugs at a discounted rate.

ACA networks in many cases are smaller and more restrictive than they were before the ACA became effective. Before the ACA, PPO (Preferred Provider Organization) plans with large networks were common. These plans permitted you to go either in- or out-of- network (you would have paid more for going outside-of-network). While PPO networks still exist, new, smaller PPO networks have been introduced in some cases, and most ACA carriers don’t offer PPOs at all.

Now, most ACA plans offer Exclusive Provider Organization (EPO) networks that allow you to use any participating provider without a referral (you must use network providers except in a medical emergency) or HMO networks (some HMO networks require referrals and others don’t, but all require you to use network providers except in an emergency).

If a particular plan is important to you, you need to check before you enroll to determine if your desired provider accepts that plan. If not, you may want to select a different plan (if available) whose network includes that provider.

Please note that networks and network provisions can change each year and that providers can leave networks any time in the year when their contracts with the carrier expire.

6. What Are Essential Health Benefits And What Is A Qualified Health Plan (QHP)?

All Affordable Care Act plans must cover these ten conditions called "Essential Health Benefits" ("EHB"):

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative (conditions a person is born with) services

- Laboratory services

- Preventive and wellness services and chronic disease management

- *Pediatric services, including dental and vision care and services for children under age 19

* This is an essential health benefit for children. If you’re getting health coverage for someone 18 or younger, this benefit must be available for your child either as part of a health plan or as a separate stand-alone plan. While this benefit must be available to you, you don’t have to buy it. Adult dental and vision services are not an essential health benefit.

Plans that cover these conditions and meet other requirements like not exceeding maximum permitted deductibles and having adequate networks of providers are referred to as "Qualified Health Plans" ("QHP").

7. What Is An Exchange (Also Referred To As A Marketplace)?

Exchanges are marketplaces where individuals and families can:

- Learn about some of their health coverage options,

- Qualify for tax credits and Cost Sharing Reductions ("CSR") [see answers to FAQ's 14 and 17 for an explanation],

- Compare health insurance plans based on costs, benefits, and other important features,

- Choose a plan, and

- Enroll in coverage.

The exchange run by the Federal government is called the Health Insurance Marketplace (or Federally Facilitated Marketplace). States running their own exchange may also name their exchanges - for example, "Access Health Connecticut" or "Covered California." Determine what type of exchange operates in your state. Find the marketplace in your state, compare plans, and enroll.

If you qualify for tax credits or a CSR, you must enroll using the link in the last sentence of the above paragraph, through a direct link from an insurance carrier’s site to the marketplace, or a web brokerage system (see FAQ 22) for a description of web brokerage systems). Please call us at 786-970-0740 (Cell) for help with your enrollment.

Those individuals/families who do not qualify for tax credits or a CSR can shop for coverage the same way they always have: through brokers and agents or directly from health insurers (this is called buying "off-exchange").

8. Can I Buy An Affordable Care Act Plan If I Have A Pre-Existing Condition?

Carriers can’t inquire or base premiums for Affordable Care Act Plans on health conditions nor can they exclude pre-existing conditions. The only factors that can be considered in determining premiums are age, smoking status, size of the family unit, and geography (usually county of residence).

9. How Are Deductibles And Out-of- Pocket Limits Determined Under Affordable Care Act (ACA) Plans?

Affordable Care Act plans have maximum "out-of-pocket limits" for all services covered by the plan. The maximum out-of-pocket is the most you can pay toward covered expenses in a calendar year, including deductibles, copays, coinsurance, and medications included in the plan’s formulary.

The maximum permitted out-of-pocket limit for ANY ACA plan in 2026 is $10,150 for individuals and $20,300 for families. Except for 2025 out-of-pocket maximums have increased every year the Affordable Care Act has been in existence. 2025 is the only year that these maximums have been reduced from the previous year.

In some cases, plans have the same deductibles and out-of-pocket maximums. If a plan's deductible is lower than the maximum out-of-pocket maximum, that plan will usually have some form of coinsurance that applies after the deductible until the out-of-pocket maximum is met.

10. How Does The Affordable Care Act Define Smoking Status?

Smoking is defined as smoking four or more times per week within the last 6 months and does not include smoking electronic cigarettes. Smoking was more strictly defined before the ACA became effective.

Note: the Affordable Care Act permits insurers to place a surcharge of up to 150% for use of tobacco. This is the only behavioral factor that can be used to rate premiums in the individual and family ACA market.

11. How Is COBRA Affected By The Affordable Care Act And By ARPA?

COBRA is not replaced by the Affordable Care Act, BUT individuals should carefully consider the effects of electing COBRA instead of purchasing an Affordable Care Act plan.

If an individual elects COBRA s/he either must have exhausted COBRA to apply during a Special Enrollment Period. Otherwise, they can apply ONLY during Open Enrollment.

In most (but not all) cases individuals will find it less expensive to elect an Affordable Care Act plan instead of COBRA. Contact us at 786-970-0740 (Cell) for more information.

Losing coverage and NOT electing COBRA is a qualifying life event (see FAQ 3) and entitles an individual to a Special Enrollment Period. Likewise, exhaustion of COBRA is also a qualifying life event.

12. What Is A Catastrophic Plan Under The Affordable Care Act?

Certain individuals can also qualify for a catastrophic plan. These are health plans that meet all of the requirements applicable to other Qualified Health Plans (QHPs) but don't cover more than 3 primary care office visits per year before the plan's deductible is met. The premium amount you pay each month for health care is generally lower than for other QHPs, but the out-of-pocket costs for deductibles, copayments, and coinsurance are generally higher.

You can't qualify for tax credits or CSRs if you elect one of these plans. To qualify for a catastrophic plan, you must (1) be under age 30; (2) over age 30 and not qualify for a tax subsidy (advance premium tax credit); OR (3) qualify for a "hardship exemption" because the marketplace determined that you're unable to afford health coverage.

Although more catastrophic plans have been become available in 2026, availability of such plans remains limited and there are few choices of carriers where such plans are offered.

13. What Is The Federal Poverty Level (FPL)?

The Federal Poverty Level ("FPL") is used to determine your eligibility for a subsidy (see FAQ 14). The Affordable Care Act (ACA) defines income as your “Modified Adjusted Gross Income” (MAGI)]. Learn more about MAGI at FAQ 14.

You’re eligible for a subsidy for 2026 if your household income is between 100% (non-Medicaid expansion states) or 138% (Medicaid expansion states) depending on the number of individuals in your family up to 4 times that amount (i.e., 400% of the FPL).

Starting with enrollments effective January 1, 2026, you’re currently NOT eligible for a tax subsidy if your income is more than 400% of the Federal Poverty Level. As explained in FAQ 1, in most cases your subsidy will be lower than it was in 2025.

Moreover, you're not eligible for a tax subsidy if your income is below your state's level for Medicaid eligibility.

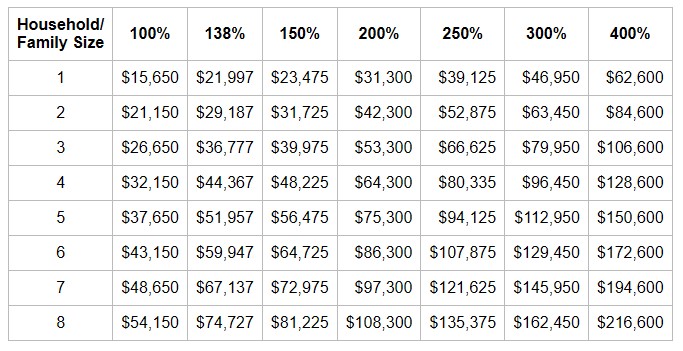

The FPL changes each year and is used for determining eligibility for subsidies. The Federal Poverty Levels at 100% of FPL for 2026 plans are as follows:

- $15,650 for a single individual

- $21,150 for a family of 2

- $26,650 for a family of 3

- $32,150 for a family of 4

- $37,650 for a family of 5

- $43,150 for a family of 6

- $48,650 for a family of 7

- $54,150 for a family of 8

NOTE: There are separate FPL levels and charts for Hawaii and Alaska. The above information and the chart below are for all the contiguous 48 states.

Federal Poverty Level Guidelines For 2026 Plans

Every year, the Federal Poverty Level (FPL) (see below) changes based on the cost of living. Individuals and families need to understand where they fall on the FPL so they know (1) whether they may qualify for Medicaid in their state (modified adjusted gross income either below 100%, or 138% of the FPL for states that have enacted Medicaid expansion); (2) if they’re eligible for a tax subsidy (also called an Advance Premium Tax Credit; see below) because they earn between 100/138% and 400% of the FPL; or (3) if they’re eligible for a Cost Sharing Reduction if they purchase a silver plan (see FAQ 19) and earn less than 250% of the FPL and also earn above the Medicaid threshold in their state.

Subsidy (Also Called An Advance Premium Tax Credit)

The Affordable Care Act requires that subsidies be provided to individuals and families who need help paying their monthly health insurance bills. Depending on age and county of residence, an unmarried individual or a family filing a joint return who makes between 100% (138% in Medicaid expansion states) and 400% of the Federal Poverty Level will usually be eligible for a subsidy (unless employer group coverage has been offered).

Federal Poverty Level and Cost Sharing Reductions

Cost Sharing Reductions are offered ONLY for silver level metallic plans. The following chart indicates the various percentages (150, 200 and 250%) of the Federal Poverty Level that are used for determining eligibility for one of the three levels of Cost Sharing Reduction.

Unmarried individuals and families can be eligible for subsidies if their Modified Adjusted Gross Income (MAGI) is below the 400% level. Unmarried individuals and families can be eligible for a Cost Sharing Reduction if their Modified Adjusted Gross Income is less than 250% of the FPL; eligibility for a level 6 CSR is for MAGI to be between 100/138% (depending on the state's eligibility level for Medicaid) and 150% of FPL; level 5 eligibility is between 150 and 200% of FPL; and level 4 eligibility is between 200 and 250%. MAGI is further explained in FAQ 14.

THIS FPL CHART IS USED TO DETERMINE TAX SUBSIDIES AND COST SHARING REDUCTIONS FOR 2026 PLANS

HOW CAN AN EMPLOYEE/FAMILY WHO ARE OFFERED GROUP COVERAGE

BECOME ELIGIBLE FOR AN ACA SUBSIDY ?

Before 2023 employees AND families could only become eligible for a tax subsidy if the EMPLOYEE’s portion of the premium for the lowest-priced “self-only” coverage was more than 9.62% of his or her HOUSEHOLD income and/or if the plan did not meet what is called the “minimum value” standard. This was called the “family glitch” and roughly 5 million people could not qualify to receive a tax subsidy.

Instead of basing the affordability determination for a family’s employer-sponsored health insurance on just the cost to cover the employee, the determination is now based on the cost to cover the employee plus family members, if applicable. The family glitch fix has been in effect since 2023.

- If a family must pay more than 9.96% of household income for the employer-sponsored plan in 2026 (this number changes annually) , they will potentially be eligible for premium tax credits in the marketplace. The same is also true if the coverage offered to the family does not provide minimum value (i.e., at least 60% actuarial value, which means the value provided by the typical bronze plan). So, if an employer offers, for example, separate coverage to family members that is affordable but that doesn’t provide minimum value, the family members would potentially still be eligible for a subsidy to buy a marketplace plan.

- There is a separate affordability determination for the employee (based on self-only coverage), and for family members (based on the total cost of family coverage). So, depending on how an employer subsidizes the cost of family coverage, it’s possible that coverage could be considered affordable for the employee but not for family members. In that case, the family members would potentially be eligible for a premium tax credit in the marketplace, but the employee would not. Employers offering a medical plan option in 2026 that costs employees no more than $129.90 for employee-only coverage will automatically meet the ACA affordability standard under the Federal Poverty Level (FPL) affordability safe harbor.

14. What Are Tax Credits (Tax Subsidies) Under The Affordable Care Act?

The Affordable Care Act provides a tax credit (called an "advance premium tax credit") to help certain individuals afford health coverage purchased through a marketplace. Advance payments of the tax credit can be used to lower your monthly premium costs.

You'll be able to calculate the amount of any tax subsidy as well as any possible Cost Sharing Reduction (see FAQs 14 and 17) for which you're eligible by going to healthcare.gov and making an application. [(We can help you make an application by using one of our web brokerage systems (see FAQ 22)].

After you complete the application, this information will be contained in the downloadable PDF (determination letter) that will be shown on your account. You should download and print this PDF for your records. Together with showing you the subsidy and any Cost Sharing Reduction information, this document will also notify you of any information (e.g., birth certificate, proof of income, copy of green card, etc.) that you must forward to the marketplace (address is shown in the PDF) by the due date shown.

If you have a qualifying life event and are eligible for a Special Enrollment Period, the determination letter will also indicate what kind of proof, if any, you need to submit to substantiate (1) that you have experienced that event and (2) that you had prior coverage (required for some but not all SEP’s).

Generally, you have 30 days to submit proof required to substantiate a qualifying life event, 90 days to submit income verification, or 95 days to submit proof of immigration status or citizenship.

Failure to provide any of this required information by the due date indicated can and usually will result either in the cancellation of your coverage or elimination of your subsidy. This information must be forwarded to the address indicated in the determination letter (or updated in YOUR healthcare.gov account).

Note: if your eligibility verification letter requires you to submit proof of a qualifying life event your plan will not become effective until you submit acceptable proof and make your first (“binder”) payment. If this occurs after your effective date of coverage, coverage will be retroactive to your effective date of coverage provided you’ve made your binder payment.

We suggest keeping the original documents and either uploading copies of the documents into the system or sending the copied information by certified mail with return receipt requested to the address listed in London, KY If you mail the information, you must enter your name, state of residence, and application id on the top of each page and include the page with the bar code (with your name, state of residence, and application id), which is contained in your eligibility verification notice. Click on the following link to find out more about submitting documents:

Once you obtain subsidy and Cost Sharing Reduction information, you can then proceed to the next step and enroll in a plan.

The final step will be to make the first payment with the carrier you have chosen. You should always keep track of the application id (also shown on the downloadable PDF) as well as the user id and password you used to access the healthcare.gov website. The state exchanges contain similar capabilities.

Income for purposes of calculating subsidies is based on MAGI (Modified Adjusted Gross Income). LEARN MORE.

MAGI includes certain adjustments to Adjusted Gross Income (your income before exemptions and deductions) and is at least equal to but can be higher than AGI. (For example, AGI includes only taxable Social Security; MAGI includes the entire Social Security benefit, whether or not it’s taxable.) Other major differences include how tax-exempt interest and foreign income are calculated for AGI vs. MAGI.

You'll be able to use a calculator included on your Federal or state marketplace to estimate the amount of your tax credit as well as any Cost Sharing Reduction. Actual subsidies and eligibility for a Cost Sharing Reduction are determined ONLY when you complete and apply to your marketplace, which produces what is called an eligibility verification letter that contains this information.

Please call us at 786-970-0740 (Cell) for help in determining the amount of your tax credit, if any, and to see if you're eligible for a Cost Sharing Reduction.

15. What is the 2025 Marketplace Integrity and Affordability Final Rule?

The Centers for Medicare and Medicaid Services (CMS) issued the “Patient Protection and Affordable Care Act Marketplace Integrity and Affordability Final Rule” on June 20, 2025, setting standards for the Health Insurance Marketplaces. The rule added additional safeguards to protect consumers from improper enrollments and changes to their health care coverage, as well as established standards to ensure the integrity of the ACA Exchanges. Some of these changes have been incorporated into the One Big, Beautiful Bill Act (OBBBA) so that future Administrations cannot change the standard by administrative procedure.

16. Paying Excess Advance Premium Tax Credits For Plan Year 2026 And Beyond

These two new Frequently Asked Questions (FAQs) issued by healthcare.gov on December 30, 2025 address commonly asked questions for APTC (advanced premium tax credit or tax subsidy) repayment starting in Plan Year 2026 (i.e., when consumers are filing their federal taxes in 2027) based on recent legislative changes:

This FAQ clarifies that if consumers did not intentionally or recklessly misrepresent their household income when enrolling in the coverage, Internal Revenue Service (IRS) rules state that this consumer may still qualify for and claim the premium tax credit on their tax return even when the household income as reported on their tax return is below 100% of the FPL.

Consumers are required to report changes that affect their eligibility for Marketplace coverage and financial assistance, including changes related to their household income, family size, and offers of other health coverage. Additionally, consumers may want to consider accepting less APTC during Plan Year 2026 (which means they would pay a higher monthly premium amount to the issuer) in order to reduce the risk of having a tax liability when they file their federal income taxes for Plan Year 2026 in 2027.

17. What Is A Cost Sharing Reduction ("CSR")?

A CSR is a discount that lowers the amount you pay out-of-pocket for deductibles, coinsurance, and copayments, but a CSR DOESN'T change the amount of your tax subsidy. CSR's can be used ONLY if you purchase a silver level plan (see FAQ 19).

You can qualify for a CSR if you purchase health insurance through an exchange and your income is below a certain level (between your state's income cut-off for Medicaid eligibility and 250% of the Federal Poverty Level). There are three different levels of Cost Sharing Reduction, and if you qualify for a CSR, the level will be indicated by where your income falls on the applicable chart in FAQ 13 above.

- Level 4 applies if your reported income is between 200% and 250% of the Federal Poverty Level. Plans at this level have an actuarial value of 73% (actuarial value means that a plan will pay that % of the average individual's medical expenses).

- Level 5 applies if your reported income is between 150% and 200% of the Federal Poverty Level. CSRs at this level have an actuarial value of 87%.

- Level 6 applies if your reported income is between your state's eligibility for Medicaid and 150% of the Federal Poverty Level. CSRs at this level have an actuarial value of 94%.

Please note that levels 4, 5, and 6 are the designations used by the Federal marketplace. Some carriers use different designations (like A, B and C) but the carrier designations are based on and equate to the marketplace levels.

Many people who are eligible for silver cost sharing reduction plans have in the past chosen bronze plans. Silver cost sharing reduction plans are often priced similarly to bronze plans and provide better benefits (e.g., lower copays and out-of-pocket maximums), so applicants with incomes at or below 250% of the Federal Poverty Level should first consider enrolling in a silver cost sharing reduction plan unless they feel a bronze level plan better fits their needs and budget. CMS has ended the practice introduced in 2024 where healthcare.gov automatically enrolled individuals with bronze plans who were eligible for silver level cost sharing reduction plans in cases where the net premiums were similar.

18. What Is Meant By Co-insurance, Co Pay, And Deductible?

"Coinsurance" - a percentage of your medical and drug costs that you pay out of your pocket.

"Copay" - the fixed dollar amount you pay when you receive medical services or have a prescription filled.

"Deductible" - the amount you pay for medical services and/or prescriptions before your plan pays for your benefits.

19. What Types Of Plans Are Available?

Plans sold on an exchange are primarily categorized into four health plan categories (also known as "metallic levels") - bronze, silver, gold, or platinum - based on the percentage the plan pays of the average overall cost of providing benefits to members.

The plan category you choose reflects the total amount an average person (i.e., a "standard" population) will likely spend ("actuarial value") for Essential Health Benefits (described in the answer to FAQ 6, above) during the year. Plans in each metallic level differ in premium and plan design.

While each plan in a metallic level has the same actuarial value determined on a standard population, you should determine what features and benefits are most important to YOUR situation (for example, a lower deductible may be more important to YOU than lower copays OR the reverse may be true), but the percentages the plans will spend, on average, are:

- 60 percent (bronze). Note: Expanded bronze plans have higher actuarial values and more robust benefits than regular bronze plans. They include pre-deductible coverage for at least one major service and have actuarial values that can extend as high as 65%--halfway between the average bronze and silver plan,

- 70 percent (silver),

- 80 percent (gold), and

- 90 percent (platinum)

These metallic categories also apply to health plans sold to individuals outside of an exchange.

20. When Must I Make The First Payment For My New Affordable Care Act Plan?

You must make payment BEFORE the effective date of coverage for coverage to be effective. It’s VERY important that premiums are paid on a timely basis, and reinstatement is not permitted for plans that have lapsed due to non-payment of premium. Payment requirements can differ between on- and off-exchange plans.

(Note: the requirements for making continuing payments for off-exchange plans can be stricter than for on-exchange plans: with some carriers, participants in off-exchange plans must make payment within 30 days of the first day of the coverage month or they’ll lose coverage, whereas other carriers permit up to 90 days. Check with your carrier to determine their payment rules and make sure you’re in compliance. On-exchange participants must submit payment within 90 days and if they’re late in paying also need to pay intervening missed payments, as well, to retain coverage. Off-exchange participants who have longer than 30-day grace periods will also have to make up intervening missed payments. To minimize chances of losing coverage due to non-payment, we recommend paying through electronic funds transfer (EFT), if possible.

Please note that you generally must make payment directly to the carrier (payments for Federal marketplace plans for most carriers cannot be made directly with healthcare.gov). You must make payments directly to the carrier or by having us enter your payment information on a web brokerage system (see FAQ 22).

In addition, if you apply for a Special Enrollment Period and the exchange requires you to submit proof substantiating the qualifying life event, you will need to submit proof to the exchange within 30 days or you will lose your coverage. The effective date of coverage will be pended until you send in the proof and the exchange accepts that proof. Upon acceptance of proof, the exchange will notify you and will also notify the carrier. You can make payment to the carrier when the carrier posts the notification they receive from the exchange to their system. It's important to make timely payment; effective date of coverage will be the date the exchange determined your effective date of coverage to be when it asked you to submit the proof.

21. What Is The Penalty For Not Enrolling In An Affordable Care Act Plan?

There is no Federal tax penalty for not having a plan that complies with the Affordable Care Act.

However, five jurisdictions--California, District of Columbia, Massachusetts, New Jersey, and Rhode Island—have state tax penalties for not having ACA-qualified plans. These penalties are all calculated differently; check with your tax preparer for information about these penalties. Vermont has a mandate that non-Medicare eligible state residents must buy an ACA-qualified plan but there is no penalty for non-compliance.

22. What Is A Web Brokerage?

This is a system that permits you to work with an insurance agent and enroll in a federal marketplace plan. You provide your personal and income information to an agent and authorize that agent to process your application with the marketplace using the web brokerage system. Working with an agent who uses a web brokerage system helps you speed up the enrollment process significantly.

Web brokerage systems must comply with HIPAA privacy and security requirements. CMS is required to certify and audit these systems and only permits those systems that meet this requirement to have what is called a direct link to healthcare.gov.

We utilize the Health Sherpa web brokerage system [which uses what is called enhanced direct enrollment (“EDE”) technology] with most of our clients who want to enroll in a marketplace plan. This significantly shortens the time it takes to complete an enrollment if we enrolled through healthcare.gov instead of using this technology. Otherwise, we make three-way calls (with us, the consumer, and the marketplace on the line) to effectuate enrollments or we assist consumers who want help in utilizing their own healthcare.gov account. We are prohibited from asking a consumer for their healthcare.gov user name and password and can NOT go on healthcare.gov as if we were the consumer.

We follow all privacy and informed consent requirements irrespective of the method of enrollment we use.

Client permission is required for us to (1) conduct an online person search; (2) complete a marketplace or non-marketplace application; (3) assist with plan selection and enrollment; and (4) assist with ongoing account and enrollment maintenance. Clients must provide written or recorded telephonic permission before we can help them complete an on-marketplace application — either through Health Sherpa or directly on healthcare.gov — and clients must validate income information and agree to attestations required by the marketplace.