Get support from reliable and trusted professionals in

Call today for quotes on

or

Medicare Overview FAQs

Select an item from the list to view information for that item.

You may also show all on the page at once.

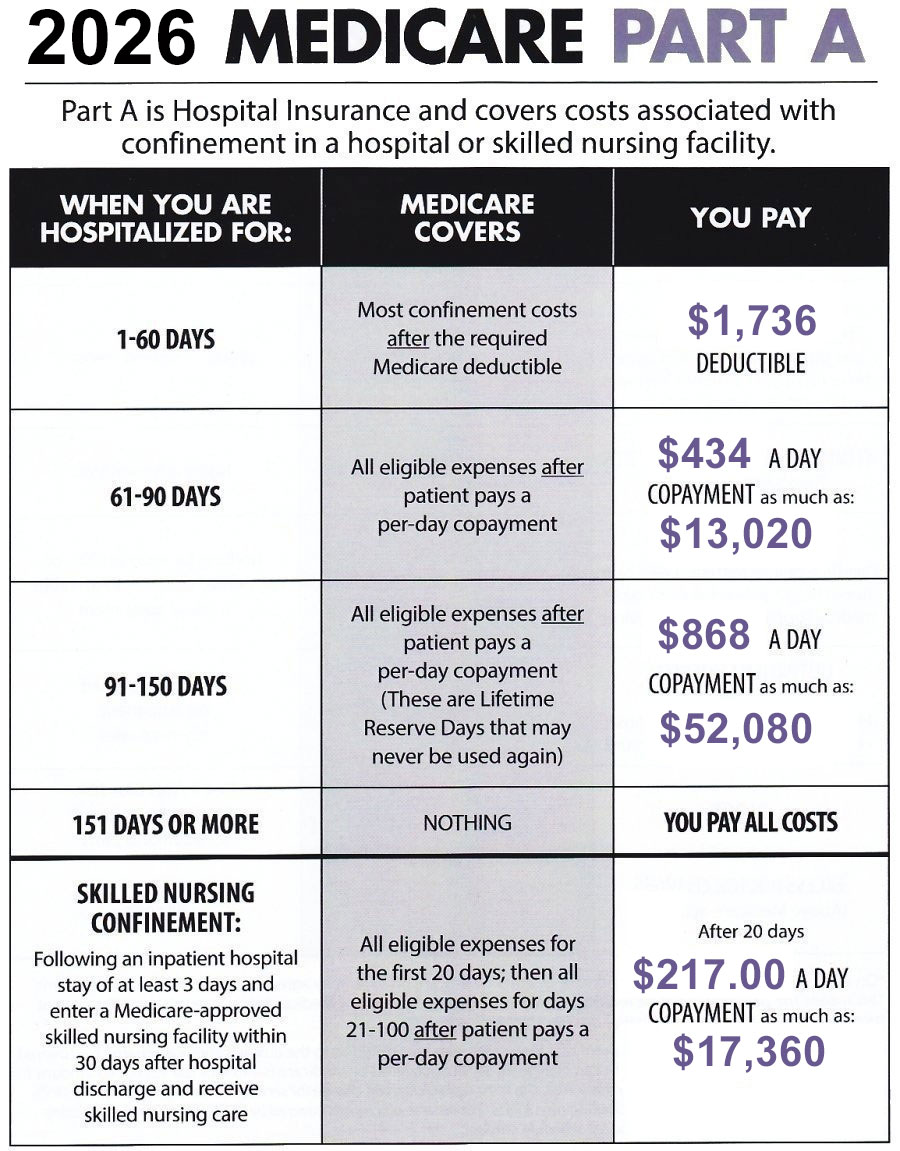

1. What Is Medicare Part A?

Medicare Part A is hospital insurance. Part A covers inpatient hospital care, limited time in a skilled nursing care facility, limited home health care services, and hospice care.

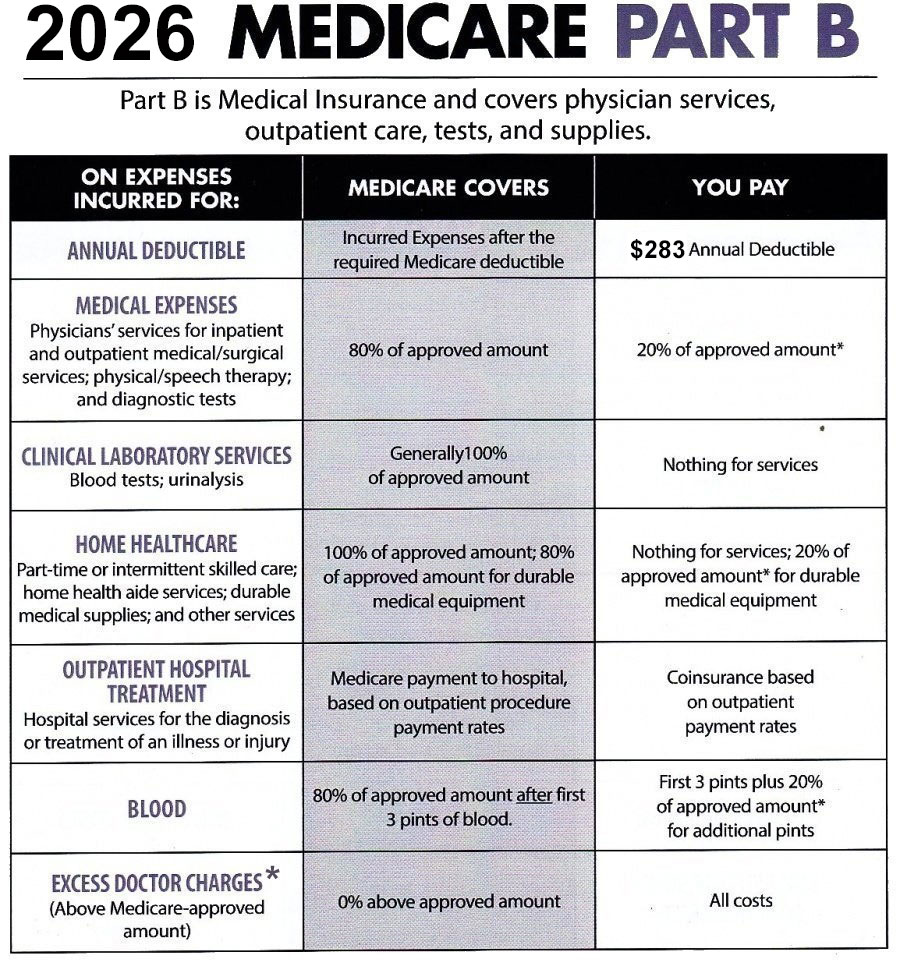

2. What Is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

*On all Medicare-covered expenses, a doctor or other healthcare provider may agree to accept Medicare assignment. This means the patient will not be required to pay any expense in excess of Medicare's approved charge. The patient pays only 20% of the approved charged not paid by Medicare.

Physicians who do not accept assignment of a Medicare claim are limited as to the amount they can charge for covered services. The most a physician who does not accept Medicare assignment can charge for services covered by Medicare is 115% of the Medicare allowable amount. This additional charge is referred to as “excess charges.” Currently, excess charges are not permitted to be assessed in Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, or Vermont.

See this guide that explains Medicare Part B Excess Charges.

3. When Is Enrollment In Medicare Automatic?

Enrollment in Parts A and B is automatic when you're 65 and receiving Social Security or Railroad Retirement benefits (of if you have Lou Gehrig's disease or have received Social Security disability benefits for 24 months). If you're automatically enrolled, you'll receive your red, white, and blue Medicare card in the mail 3 months before your 65th birthday or your 25th month of disability.

4. What Must I Do If I'm Not Automatically Enrolled In Medicare?

You need to sign up for Parts A and B if you aren't already receiving Social Security or Railroad Retirement benefits. You can enroll by going to the Social Security website at https://secure.ssa.gov/iClaim/rib. If the site asks you if you are enrolling for Part A and/or B answer Yes. The site will also ask you if you are applying for Social Security. Be sure you answer this question correctly because if you don’t you could be signed up to receive Social Security if you don’t want to or vice versa.

Note: the medicare.gov site says enrollment for Part A of Medicare is automatic if you’re eligible for premium-free Part A. HOWEVER, if you’re not applying for Part B of Medicare (for example, if you’re covered by an employer group plan at a company with 20 or more employees) Medicare is no longer sending out Medicare cards that indicate a person is enrolled for Part A and not Part B. If you’re delaying enrollment for Medicare at age 65 because of participation in an employer group plan, it’s advisable to contact Medicare at 800-633-4227 and ask them to enroll you for Medicare Part A.

If you’re turning 65 and work for a company with less than 20 employees you should enroll for Parts A and B of Medicare at age 65. (See FAQ 7.) Medicare is considered the primary plan in these situations and if your employer provides coverage at and after 65, the amounts that would have been paid by Medicare Parts A and B will be deducted from your employer plan benefit, because in this situation the employer plan is considered the secondary plan. (If you work for a company that has less than 20 employees and don’t sign up for Part B at age 65 you won’t be permitted to sign up for Part B until what is called the “general enrollment period” which runs from January 1 through March 31, and you will incur a lifetime penalty of 10% of the Part B premium for each full year you have delayed enrollment into Part B. You won’t be able to enroll in a Medicare Supplement, Medicare Advantage Prescription Drug, or Medicare Advantage (only) plan until you’re enrolled for Parts A AND B of Medicare.)

When you're first eligible for Medicare, you have a 7-month Initial Coverage Enrollment Period ("ICEP") to sign up for Part A and/or Part B. This period begins three months before your 65th birthday month and ends the last day of the third month after your birth date month. We recommend signing up for Medicare early in the third month before your effective date to avoid any delays in enrollment dates. Your enrollment date will be the first of the month in which you are eligible if you apply before that date or the first of the following month if you submit during your eligibility month or any of the following three months. Unless you're enrolled in a group plan covering 20 or more people there will be a penalty and a restricted enrollment period between January 1 and March 31 (called the “General Enrollment Period”) if you don't enroll during the ICEP.

5. When Am I Eligible For Medicare?

Use this CALCULATOR to get an estimate of when you're eligible for Medicare.

6. What Can I Do If I Didn't Sign Up For Medicare When First Eligible?

If you're eligible for premium-free Part A (see question 8 for a definition of "premium free" Part A) because you or your spouse have paid Medicare taxes for at least 40 quarters (10 years), you can sign up for Part A at any time.

If you must buy Part A and/or Part B or re-enroll because of loss of coverage), you can only sign up during a valid enrollment period. If you don't enroll when you're first eligible [generally three months before and up to three months after your 65th birthday month (there are special rules for individuals who don't enroll because they had group coverage with an organization with 20 or more employees)], in most cases you can only enroll in Parts A and/or B between January 1 and March 31 (the "General Enrollment Period"), and the effective date will in most cases be the first of the following month. In such case enrollment eligibility dates for a Medicare Supplement, Medicare Advantage, Medicare Advantage Prescription Drug, or Medicare drug coverage (Part D) plan will be different than they were in 2024 and previous years. There will be a limited time to enroll for such a plan, and you should check frequently to determine if your application for Part A and/or B has been approved (it’s best to create a mysocialsecurity.gov account so you can check status) and contact us at 561-734-3884 or 877-734-3884 (TTY:711) once you find that you’re in stage three (this means your application has been approved) or if you otherwise obtain your Medicare Beneficiary Identifier (i.e., your Medicare number) and Part A and/or B effective date(s). The effective date for Medicare Advantage, Medicare Advantage Prescription Drug, and stand-alone Part D drug plans is generally the first of the month after making application, and the effective date could be 2/1, 3/1, 4/1, 5/1, or 6/1 if application is made for Part B during the General Election Period. When we receive your call we’ll determine when you need to enroll; if you don’t enroll during this period you won’t be able to enroll until the next Annual Enrollment Period (this runs from October 15 to December 7) for a January 1 of the following year effective date.

Please contact us at 561-734-3884 or 877-734-3884 (TTY:711) if you’ve lived overseas, not been enrolled for Medicare, returning to live in the United States, and want to know more about how and when you need to make application to enroll in Medicare.

There are special enrollment periods for enrollment in Part B and non-premium free Part A for these situations for those who can’t sign up when first eligible:

- Individuals impacted by an emergency or disaster—up to six months after the end of the emergency declaration.

- Individuals impacted by a health plan or employer error—up to six months after the individual notifies Social Security of the error.

- Formerly incarcerated individuals—up to 12 months post-release. Such individuals may choose between retroactive coverage back to their release date (not to exceed 6 months) or coverage beginning the month after the month of enrollment. If an individual selects retroactive coverage, they must pay the premiums for the retraoctive time period.

- Individuals whose Medicaid is terminated—up to six months after termination of Medicaid. The same retroactive provision opportunity that exists in the preceding bullet is applicable.

- Individuals with other exceptional circumstances—allows CMS (Medicare), on a case by-case basis, to grant a 6-month special enrollment period when circumstances beyond the individual’s control prevented them from enrolling during the Intial Election Period (IEP), General Election Period (GEP), or one of the above Special Election Periods (SEPs).

You cannot use the Annual Enrollment period that runs from October 15 to December 7 to enroll in Medicare Part A or Part B. That enrollment period can only be used by people with Medicare to sign up for Medicare Advantage, Medicare Advantage Prescription Drug, or separate Medicare drug coverage (Part D), or switch coverage that you already have.

There's a late enrollment penalty if you don't sign up for Medicare Part B when first eligible.

You have six months from your Part B effective date to enroll for a Medicare Supplement plan without having to answer medical questions. Otherwise, you can enroll at any time, but you will need to pass medical underwriting rules for the specific carrier you are applying for.

You can enroll in a Medicare Advantage or Medicare Advantage Prescription Drug Plan three months before and up to three months after the later of your Part A or Part B effective date. Otherwise, you can enroll in one of these types of plans ONLY if you have a Special Enrollment Period or during the Annual Enrollment Period.

You can enroll for Medicare drug coverage (Part D) three months before and up to three months after the month of your Part A OR Part B effective date, whichever is earlier. Otherwise, you can enroll in Medicare drug coverage (Part D) ONLY if you have a Special Enrollment Period or during the Annual Enrollment Period.

See the Medicare Supplement, Medicare Advantage (Part C) and/or Medicare Drug Coverage (Part D) pages for additional details or call us at 561-734-3884 or 877-734-3884 (TTY: 711) for more information because the rules for enrolling in one of these plans when you've enrolled for Part A or B during general enrollment (or when leaving an employer group plan) are unique and not well understood.

7. What If I Didn't Sign Up For Medicare Because I Had Group Coverage Based on Current Employment?

If you didn't sign up for Parts A and/or B because you had employer group coverage based on current employment and your employer has 20 or more employees, you can enroll in Parts A and/or B any time as long as you or your spouse are working and are covered under group coverage. [If your employer has 20 or fewer employees you should sign up for Parts A and B when first eligible or you will be assessed a late enrollment penalty for Part B when you finally sign up and you’ll only be permitted to enroll in Part B during the general election period (see FAQ 6).]

NOTE: we recommend that those on employer group coverage with larger employers (20 or more employees; see first paragraph) contact Medicare to sign up for Part A when they turn 65. Enrollment in Part A is no longer automatic, and enrollment in Part A will make Medicare the secondary payor in the event the employee incurs hospital expenses that are not paid under the employer group plan. Part A has a deductible and if Medicare is the secondary payor the deductble must be paid before Medicare pays any Part A expenses; neverthless, enrolling in Part A could reduce the employee’s out of pocket expenses if the employee has unpaid hospital expenses exceeding the Part A deductible.

If your employer with 20 or more employees provides group coverage and you are enrolled in an employer group plan, you also have an 8-month period to sign up for Part A and/or B that begins the month after employment ends or the group health plan insurance based on current employment ends. There's no penalty provided you sign up within 8 months after the loss of group coverage. (NOTE: if your employer has less than 20 employees, you should sign up for Part B when you are first eligible (see above paragraph and FAQ 6).

Individuals of employers with 20 or more employees who are about to retire and have had employer coverage will have a Part A effective date if they have previously contacted Medicare to enroll in Part A. Otherwise, Medicare will assign a Part A date which in most cases will be six months prior to the Part B date when the employee applies for Medicare and the Part B effective date is established. (See the NOTE regarding enrollment in Part A in the second paragraph, above.) For people who are leaving employer group coverage we’ve found that it’s more expeditious, if possible, to apply through the local Social Security office, even though Medicare prefers online enrollments. The reason we recommend in person enrollment is that we’ve found that the two required forms (see below) are sometimes lost or misplaced when one applies online. It’s important to sign up for Medicare before the first month of retirement so there is no gap in insurance coverage. We suggest appying early in the third month before you intend to retire (the last day of active employement is normally the last day of the month and the first day of retirement is normally the first of the following month). If there’s a question on the application about Medicare Part A answer whether or not you’re enrolled in that coverage and indicate that you want Part A if the application asks about this. As part of your application, you’ll need to:

- Complete an Application for Enrollment in Part B (Form CMS-40B); AND

- Complete the top portion and have your employer complete and sign a Request for Employment Information (Form CMS-L564).

8. How Much Are Medicare Premiums?

Most Medicare Part A beneficiaries don't have to pay a monthly premium to receive coverage under this part of Original Medicare; this is called "premium-free Part A." Generally, if you've worked at least 10 years (40 quarters) and paid Medicare taxes while you worked, you're eligible for premium-free Part A. Otherwise, you pay a monthly premium.

About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. Beneficiaries age 65 and over who have fewer than 40 quarters of coverage and certain persons with disabilities pay a monthly premium to voluntarily enroll in Medicare Part A. Individuals who had at least 30 quarters of coverage or were married to someone with at least 30 quarters of coverage may buy into Part A at a reduced monthly premium rate. This will be $311 in 2026, which is a $26 increase from 2025. Certain uninsured aged individuals who have less than 30 quarters of coverage and certain individuals with disabilities who have exhausted other entitlement will pay the full premium, which will be $565 a month in 2026, a $47 increase from 2025.

You pay a monthly premium for Part B of Original Medicare. The fee can be higher for people with high incomes (see FAQ 9 below.)

Most Medicare beneficiaries pay $202.90 for Part B in 2026, an increase of $17.90 from the $185.00 paid in 2025. (This is called the "standard" Part B premium.) The increase for 2026 is due mainly to projected price changes and assumed increases in benefits usage that are consistent with historical experience. The Trump Administration addressed unprecedented spending on skin substitutes and finalized these changes in the 2026 Physician Fee Schedule Final Rule. Had these changes not been made, the Administration estimates the Part B premium increase would have been an additional $11.

Because of the "hold harmless" provision, increases in Medicare premiums can't cause a person's Social Security benefits to decline from one year to the next. Unless an individual has or ever had to pay IRMAA payments (see question 9), an individual’s net Social Security benefit can’t decrease because of an increase in Part B premiums.

Beneficiaries with Modified Adjusted Gross Incomes (MAGI) above a certain amount (see answer to question 9) pay a higher amount.

The Social Security cost of living (COLA) benefit increase for 2026 is 2.8%, which is more than the 2.5 increase for 2025 but less than the 3.2% and 8.7% increases for 2024 and 2023, respectively.

Part B Benefit And Premium For Beneficiaries With Kidney Transplants

Individuals whose full Medicare coverage ended 36 months after a kidney transplant and who do not have certain other types of insurance coverage can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. For 2026, the standard immunosuppressive drug premium is $121.60, an increase of $11.30 from 2025.

9. What Are Part B and Part D Premiums For People With High Incomes?

Since 2007, a beneficiary’s Part B monthly premium has been based on his or her income, and since 2011 a beneficiary’s Part D (outpatient drug coverage) monthly premium has also been affected by income. These two separate income-related monthly adjustment amounts (referred to and abbreviated as “ Part B IRMAA” and “Part D IRMAA” ) affect roughly 8% of Medicare beneficiaries with Part B coverage, as well as about 8% of those with Medicare prescription drug coverage (Part D).

Individuals affected by the Part D IRMAA pay the adjustment amount in addition to their Part D premium. Part D premiums vary by plan.

Part B and D IRMAA amounts (including the standard Part B premium of $202.90 for 2026) are deducted from Social Security benefit checks if the beneficiary is receiving Social Security; otherwise, Medicare bills the beneficiary directly.

Beneficiaries can elect to deduct their basic Part D premiums from Social Security or make payment directly to the carrier; provisions for making payment for the basic premium vary by carrier. About two-thirds of Part D beneficiaries pay their basic premium directly to the carrier, while the remainder have their premiums deducted from their Social Security checks.

For 2026, individuals filing single returns (as well as married individuals who file separate returns) with modified adjusted gross income over $109,000 and joint filers with modified adjusted gross income over $218,000 pay additional premiums both for Medicare Part B and for Medicare drug coverage (Part D). [Note: Part D IRMAA applies both to Medicare Advantage Prescription Drug Plans and separate Medicare drug coverage (Part D)]. LEARN MORE about how IRMAA is calculated.

IRMAA is calculated annually based on income reported on the tax return from two years’ previously. If no return has been filed, then they’re based on the most recent income tax return that is on file with the IRS. The income levels upon which IRMAA is based are adjusted for cost-of-living, and the various levels in the charts are periodically changed legislatively as well.

Individuals who have experienced one of the following life changing events can file a form SSA-44 to request a reduction in their IRMAA if one of the following events occurs:

- Marriage

- Divorce/annulment

- Death of a spouse

- Work stoppage

- Work reduction

- Loss of income-producing property

- Loss of pension income

- Employer settlement payment

IRMAA Premiums for 2026

See these charts for 2026 IRMAA Part B premiums and for 2026 IRMAA Part D premiums.

10. How Can I Estimate My Medicare Part B Premium If I Have High Income?

Use this CALCULATOR to determine your Medicare Part B Premium.

11. What Are Part A and B Enrollment Requirements For Medicare Supplement, Medicare Advantage, And Part D Prescription Drug Plans?

You must have both Parts A and B to enroll in a Medicare Advantage or Medicare Advantage Prescription Drug plan. There are no medical questions unless you are applying for a Chronic Special Needs Plan (e.g., one for chronic kidney disease, lung disorders, or heart conditions) that requires you to attest to having that condition as a condition of enrollment. A physician must attest that you have that condition or you’ll disenrolled for that plan and given a special election period election to enroll in a non-Chronic Special Needs Plan.

You can buy a Medicare Advantage or Medicare Advantage Prescription Drug plan only (1) when you are first eligible; (2) between October 15--December 7 for a January 1 effective date; or (3) during a Special Enrollment Period. You can change to a different Medicare Advantage or Medicare Advantage Prescription Drug Plan between January 1--March 31 during what is called the Open Enrollment Period if you already have a Medicare Advantage or Medicare Advantage Prescription Drug Plan. (If you enroll in a Medicare Advantage or Medicare Advantage Prescription Drug Plan during your Initial Coverage Election Period, you can change to a different Medicare Advantage or Medicare Advantage Prescription Drug plan during the first three months starting with the month you became eligible for Parts A and B.) LEARN MORE ABOUT MEDICARE ADVANTAGE (PART C) PLANS.

You must have Part A and/or Part B to buy separate Medicare drug coverage (Part D). There are no medical questions. You can only buy a Part D Prescription Drug plan when you're first eligible, between October 15--December 7 for a January 1 effective date, during a Special Enrollment Period, or, if you have a Medicare Advantage or Medicare Advantage Drug Plan and elect to go back to Original Medicare during the Open Enrollment Period [(1/1-3/31 or the first three months after enrolling in a Medicare Advantage or Medicare Advantage Prescription Drug Plan during your Initial Coverage Election Period (i.e. starting with the month you first became eligible for Parts A and B of Medicare)]. LEARN MORE ABOUT MEDICARE DRUG COVERAGE (PART D).

If you must buy Part A and/or Part B, you can only sign up during a valid enrollment period. If you don't enroll when you're first eligible [generally three months before and up to three months after your 65th birthday month (there are special rules for individuals who don't enroll because they had group coverage with an organization with 20 or more employees)], in most cases you can only enroll in Parts A (NOTE: if you’re eligible for premium-free Part A you can enroll for Part A at any time) and/or B between January 1 and March 31 (the "General Enrollment Period"). New rules were established in 2025 for when a person can sign up for a Medicare Supplement, Medicare Advantage, Medicare Advantage Prescription Drug plan, or Medicare Drug Coverage (Part D) for those who enroll in Part A and/or B during the general enrollment period. If you’re enrolling during the general enrollment period, please contact us at 561-734-3884 or 877-734-3884 (TTY: 711) as soon as you make application for Part A and/or B so we can explain these new rules to you.

12. How Can Someone Save Money On Health Care Or Drug Costs?

You may qualify to save money on health care and/or drug costs if you are eligible for any of these programs. Those with low incomes and assets should deterine if they are eligible for the “extra help” (aka “low income subsidy”) program and apply on line at socialsecurity.gov if they think they can or might qualify. Extra help is a poorly understood program and many people qualify for it but are not aware of their eligibility (or even that the program exists). This program can substantially lower your costs for medications, particularly the more costly preferred medications, and those on extra help are not subject to the late enrollment penalty for not having creditable drug coverage prior to enrolling.