Get support from reliable and trusted professionals in

Call today for quotes on

or

Medicare Supplement FAQs

Select an item from the list to view information for that item.

You may also show all on the page at once.

1. What Is A "Modernized" Medicare Supplement Plan?

Medicare Supplement plan choices changed as of June 1, 2010 and plans offered on or after that date are called "modernized" plans. Certain prior plans (E. H, I and J) were eliminated and Plans D and G were modified. These eliminated and changed plans were "grandfathered," and beneficiaries with those plans have been allowed to retain them. In most instances it's in the best interest of beneficiaries to keep their grandfathered plans rather than to purchase a "modernized" plan.

2. What Plans Are Available?

NOTE: Starting January 1, 2020, Medigap plans sold to people new to Medicare aren’t allowed to cover the Part B deductible. Because of this, Plans C, F, and Hi Deductible F are no longer available to such individuals. If you already have one of these plans as of January 1, 2020 you'll be able to keep your plan. Also, if you qualify for Medicare before January 1, 2020, but are not yet enrolled, you may be able to buy one of these plans.

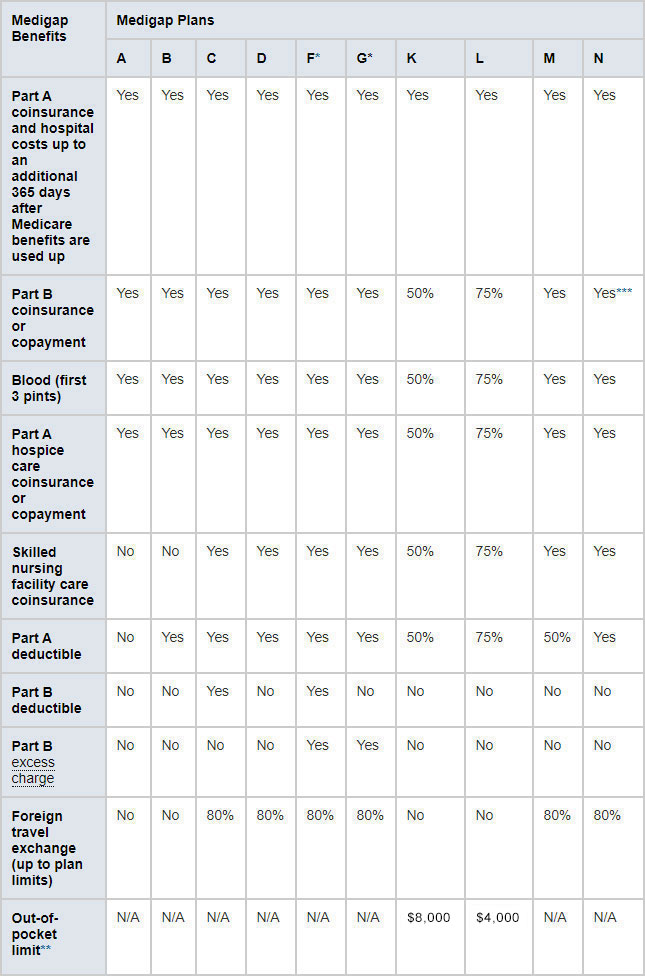

The chart below shows basic information about the different benefits Medigap policies cover in 2026.

Yes = the plan covers 100% of this benefit

No = the policy doesn't cover that benefit

% = the plan covers that percentage of this benefit

N/A = not applicable

* Plans F and G (as well as the J plan that existed prior to 2010) also offer a high-deductible plan. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,950 in 2026 before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020 and Plan J has not been offered since 2010).

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N does not cover the Part B deductible or Part B excess changes, and there are copayments of up to $20 for some office visits and up to $50 for emergency room visits that don't result in inpatient admission.

You live in Massachusetts, Minnesota, or Wisconsin

If you live in one of these 3 states, Medigap policies are standardized in a different way.

- You live in Massachusetts

- You live in Minnesota

- You live in Wisconsin

3. What Providers Are Covered?

Unless an individual purchases a "SELECT" plan (see question 4), s/he is eligible for treatment by ANY provider who accepts Medicare anywhere in the U.S.

Providers who accept Medicare but don't take Medicare assignment (payment directly from Medicare), are permitted to charge up to 15% (this is called an "excess charge"). Plans F and G cover excess charges; Plans A, B, C, D, K, L, M, and N do not. Excess charges are not permitted to be assessed in Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, or Vermont.

4. What Is A Medicare SELECT Plan?

Medicare SELECT is a type of Medigap policy sold in some states that requires you to use hospitals and, in some rare cases, doctors within its network to be eligible for full insurance benefits (except in an emergency). Any of the standardized plans (see question 2) can come in a SELECT version.

If you have a SELECT plan and don't use a Medicare SELECT hospital or doctor (if applicable) for non-emergency services, you'll have to pay some or all of what Medicare doesn't pay. Medicare will pay its share of approved charges no matter which hospital or doctor you choose provided the provider accepts Medicare.

A SELECT plan is less expensive than a standardized plan with the same letter designation.

SELECT plans are offered by only some carriers and only in certain states and zip codes. When these plans are offered, they're usually restricted to certain zip codes and plans, and only a small number of hospitals are usually included in the network.

5. Where Can I Find Available Plans?

Medicare Supplement policies can generally be purchased at any time and, unlike Medicare Advantage or Part D prescription drug plans, do not have "lock in" provisions that prevent individuals with such plans from changing plans or carriers. You cannot be charged extra or refused coverage during the Medigap Open Enrollment Period (a period that lasts 6 months and begins on the first day of the month in which the beneficiary is both 65 or older and enrolled in Medicare Part B).

Unless a beneficiary has a guaranteed issue right or buys a Medicare Supplement during the Medigap Open Enrollment Period, Medicare Supplement plans utilize medical underwriting, which means that you can be rejected or charged extra for a health condition. Individuals with Medicare Advantage plans can buy Medicare Supplement plans during the Annual Election (Enrollment) Period that runs from October 15--December 7 for a January 1 effective date, and the Medicare Supplement carrier can utilize medical underwriting unless the individual is in the Medigap Open Enrollment Period.

During the Open Enrollment Period (1/1-3/31 or during the first three months after electing a Medicare Advantage or Medicare Advantage Prescription Drug Plan at age 65 during the initial coverage election period), individuals who have Medicare Advantage or Medicare Advantage Prescription Drug plans can elect to return to Original Medicare (Parts A and B) and also purchase a Medicare Supplement and/or stand-alone Part D plan. Unless such an individual has what is called a "guaranteed issue right" (for example, what is called a Medicare "trial right"), Medicare Supplement plans bought outside of the Medigap Open Enrollment Period are subject to medical underwriting.

Medical underwriting requirements, which apply in situations other than open enrollment and guaranteed issue, differ between each carrier. However, all plans with the same letter designation provide the same level of benefits.

Eleven states--California, Idaho, Illinois, Kentucky, Louisiana, Maryland, Nevada, Oklahoma, Oregon, Utah, and Virginia---have “birthday” rules for changing Medicare Supplement plans. This is an annual protection afforded to Medicare beneficiaries presently enrolled in a Medicare Supplement Plan that provides an open enrollment period available for a specific timeframe around the beneficiary’s birthday that allows presently enrolled Medicare Supplement individuals to change to a different Medigap policy (or, depending on the state the same plan with a different carrier) without underwriting or a waiting period. Each state with a birthday rule has its own specific regulations concerning what changes can be made and timeframes, so it’s important to check the details for your state.

Three states---CT, NY, and MA-- permit individuals to purchase Medicare Supplement plans at any time without medical underwriting and are considered continuous guarantee issue states. In addition, Maine provides annual quaranteed issue where policyholders are given the opportunity to switch to plans of equal or less value once a year at any time; this right does not permit buying a Medicare Supplement plan for the first time on a guarantee issue basis outside of the Medigap Open Enrollment Period.

Some Medicare carriers permit members to change plans with no underwriting at any time (either to any plan offered by that carrier or to a plan providing lesser benefits, depending on the carrier) and others have rules permitting members to change to certain plans (e.g., on the two-year anniversary date).

Call us at 561-734-3884 or 877-734-3884 (TTY: 711) for more information and help in enrolling in a plan.

6. What Is A "Trial Right"?

You have a guaranteed issue (i.e. a right to buy a Medicare Supplement policy with no underwriting) if:

1. You joined a Medicare Advantage plan when you were first eligible for Medicare Part A at age 65 (note that you must have enrolled as of the first of the month you were first eligible for Medicare Part A at age 65 or you don't qualify for this trial right) and within the first year of joining, you decide you want to change to Original Medicare; or

2. You dropped a Medigap policy to join a Medicare Advantage Plan (or to switch to a Medicare SELECT policy) for the first time, you've been in the plan less than a year, and you want to switch back.

You have different rights to buy certain Medigap policies, depending on which "trial right" you're exercising.

If you have the first trial right, you can buy any Medigap policy that's sold in your state by any insurance company.

If you have the second trial right, you have the right to buy the SAME Medigap policy you had before you joined the Medicare Advantage Plan or Medicare SELECT policy, if the SAME insurance company you had before still sells it. If your former Medigap policy isn't available, you can buy any Medigap Plan A, B, C, F, K or L that's sold in your state by any insurance company. (Individuals not eligible to buy Plans C or F must be offered Plans D and/or G instead.)

Click here for details about trial rights.

Note: The above are minimum standards for trial right requirements and are contained in the Choosing a Medigap Policy publication. Some states have liberalized these requirements, and some carriers provide an additional 12 months under certain circumstances. Please call us at 561-734-3884 or 877-734-3884 (TTY: 711) to discuss what trial rights may apply to your particular state and situation.

7. What’s The Availability Of Plans C and F?

Here's what you need to know about the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) which eliminated Plans C, F, and Hi Deductible F ONLY for those born before January 1,1955 with Medicare Part A effective dates on or after January 1, 2020.

- Anyone eligible for Medicare Part A before January 1, 2020 can enroll in a Plan C, F, or, Hi Deductible F even after 2020 and can keep their plan as long as they choose.

- Anyone born January 1, 1955 or later will NOT be able to purchase Plan C, F, or Hi Deductible F. Plan G (the same as Plan F except the insured is responsible for the Part B deductible) continues to be available in addition to all the other options (i.e. Plans A, B, D, K, L, M and N) and has become the most popular Medicare Supplement plan. A Hi Deductible Plan G is available as well.

- Insureds ALREADY enrolled in Plans C, F or Hi Deductible F do not need to take any action. Plans C, F, and Hi Deductible F will still be available for consumers eligible to purchase them in 2020 and beyond.

Please see this compliance update that summarizes all of the MACRA changes that took effect January 1, 2020.